The project is a DeFi platform offering relatively high yields of up to 31% APY.

Although the project is new, we’re particularly interested in their influencer marketing strategy, as the team has done an impressive job of drawing attention to their platform.

Сайт: https://infinifi.xyz/

X/Twitter: https://x.com/infinifilabs/

Discord: https://discord.com/invite/93CUkjEkXF

Website Review

The main headlines — “Better than a bank” and “The highest yield with transparent terms” — are attention-grabbing.

The presence of partners increases trust, but there is a lack of additional information.

The product is in its early stage, so the website currently lacks detailed information.

However, there is a link to the Litepaper in the site header, where most questions are answered.

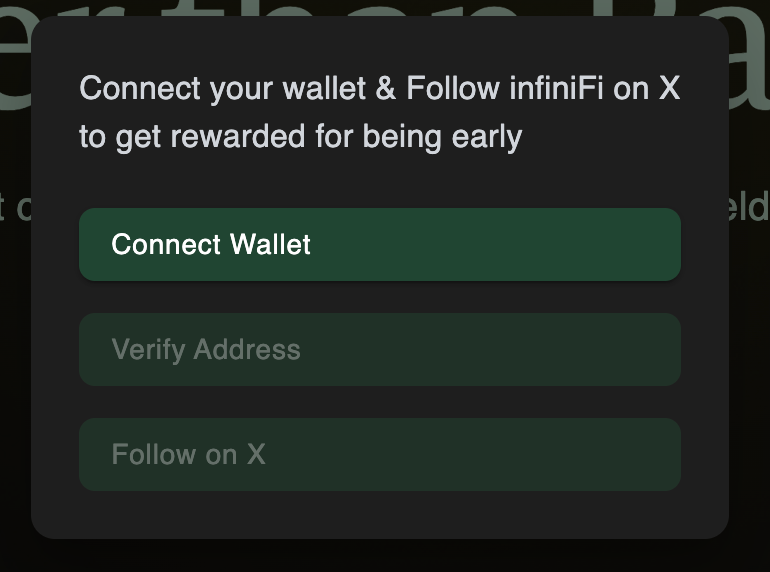

To get started, users need to complete three steps:

- Connect a wallet

- Verify your email address

- Follow on Twitter

The last step is quite strategically designed — most likely, it’s the main reason behind the large number of Twitter followers (48k).

Product Overview

Key Features of infiniFi

1. Innovative Fractional Staking Model

• Utilizes a fractional reserve model similar to traditional banks, but on the blockchain — enabling higher yields without increased risk.

• Solves the maturity mismatch problem between liquid liabilities and illiquid assets.

2. Investor-Driven Management

• Asset allocation is based on depositor preferences (bonding periods).

• More capital equals more influence — encouraging responsible participation.

3. Automated Duration Matching (Laddering)

• Users select a desired lock-up period (1–13 weeks).

• The platform automatically matches these periods with appropriate assets, minimizing liquidity risk.

4. Enhanced Yields

• Yields are higher than those in traditional finance:

• Liquid users earn better returns than in standard “liquid farms.”

• Locked users earn even more due to overall optimization.

5. Full Transparency via Blockchain

• All assets are held on DeFi platforms and can be verified at any time.

• No intermediaries or centralized risks — all managed via smart contracts.

6. iUSD Mechanism

• Users deposit stablecoins (USDC, USDT, FRAX) and receive the iUSD token.

• iUSD can be used as a liquid asset or locked for higher yield.

• Users can exit anytime if liquidity is available.

7. Protection Against Sudden Withdrawals

• Curve is used as a liquidity reserve.

• During high withdrawal demand, iUSD may trade at a discount, but it remains asset-backed.

• In the future — a Stability Pool will buy back iUSD if it drops below 1:1.

8. Bridge Between TradFi and DeFi

• Potential to tokenize traditional assets with higher yield.

• Enables refinancing of TradFi via DeFi infrastructure.

Potential Risks of infiniFi

1. Liquidity Risk

• If too many users try to withdraw funds simultaneously, liquid reserves may be depleted.

• In that case:

• iUSD may trade below the 1:1 ratio with stablecoins.

• Exits may only be possible via secondary markets (e.g., Curve) or by waiting for locked assets to become available.

• Until a stable Stability Pool is launched, this risk remains higher.

2. DeFi Infrastructure Risk

• The platform relies on third-party protocols (e.g., AAVE, Curve). If anything goes wrong with them (hacks, bugs, insolvency), infiniFi could be affected.

• Smart contracts are vulnerable to:

• Bugs

• Hacks

• Logic errors

3. Systemic Risk of Fractional Reserves

• The fractional reserve model works as long as user trust remains high.

• A mass panic (bank run) could destabilize the system, even if assets are technically backed.

4. Duration Matching Risk

• The automated laddering system might miscalculate liquidity needs, especially during volatile periods.

• If the model misfires, the platform could temporarily become illiquid.

5. iUSD Secondary Market Risk

• In case of liquidity shortages, iUSD may be traded at a discount.

• Users who don’t want to wait may face losses when withdrawing funds.

6. Legal and Regulatory Risks

• Regulators may classify infiniFi’s operations as illegal banking activity, especially due to the use of fractional reserves.

• DeFi platforms may face regulatory pressure, access blocks, or other restrictions in certain jurisdictions.

7. Psychological Risk

• Participants must trust mechanisms they might not fully understand (smart contracts, laddering, fractional reserves).

• Low financial literacy or fear of DeFi could trigger panic actions and system instability.

Twitter Promotion for the DeFi Project

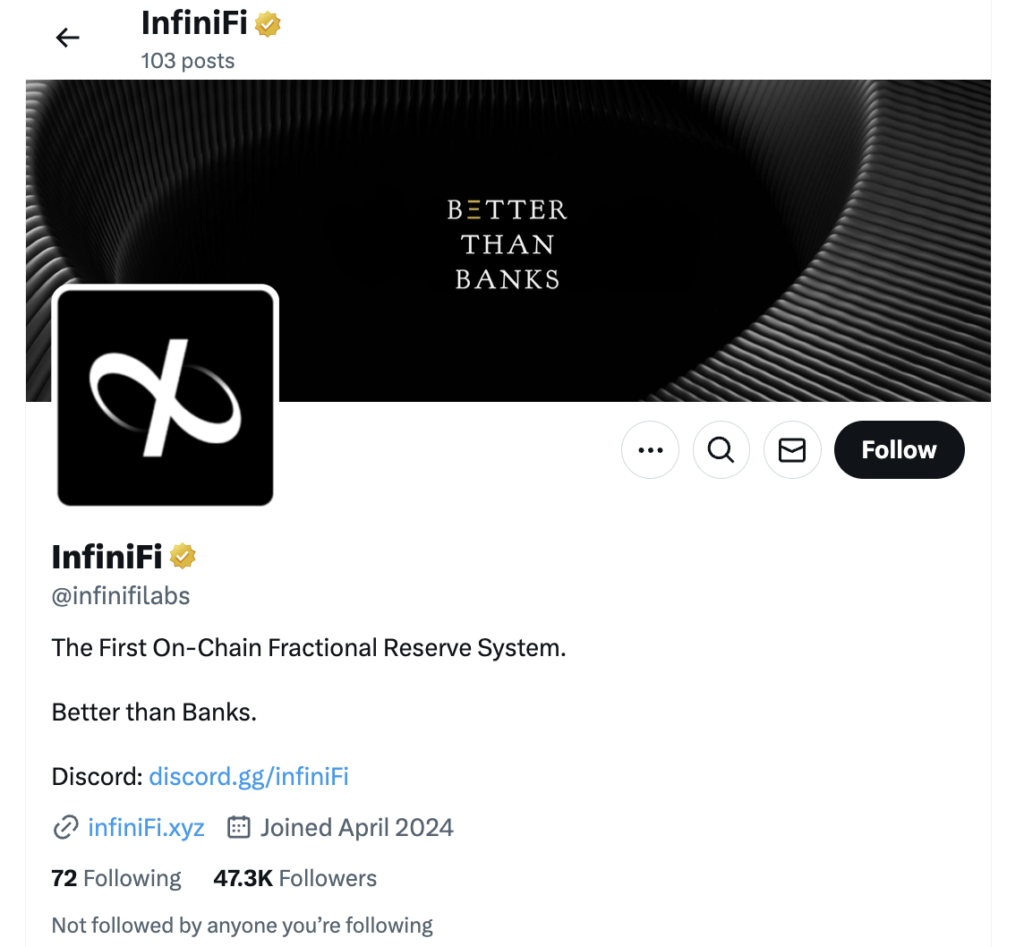

The project’s first post dates back to February 2025. This immediately raises questions about the number of followers — why is it so high?

There could be several explanations:

- Rapid promotion of the project, possibly driven by high-engagement posts related to investment announcements.

- The account may have belonged to a previous project, with its posts and history wiped.

- As seen before, a viral mechanic like “want to join the waitlist? — follow us” could be in play.

The project team doesn’t have large personal accounts, so we can’t say there are influencers within the team itself.

Our main interest lies in the Replies section, where we can find the most viral posts.

The account’s first reposts are responses to comments on its early posts. There are dozens of these — a surprisingly large number.

Is this effective? Most likely, yes — at the very least, it creates user engagement and highlights interesting tweets.

The first AMA sessions from the project’s CEO appeared in niche media outlets. At crypto teki, we always place a strong emphasis on this format — it’s a direct way for a brand to communicate with its target audience.

We can also help you set up this process: we’ll find relevant media, negotiate terms, and organize everything from start to finish.

Take a look at the event frequency — the initial activities:

A very impressive and rapid rise — they’ve already moved on to larger conferences, all within just a few weeks.

Mandatory reposts (preferably with video) of all content that mentions project participants or the main account.

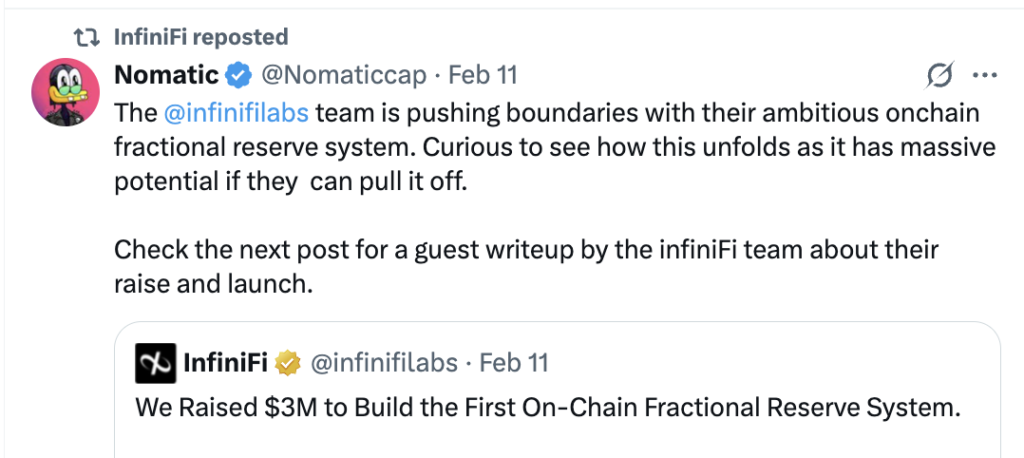

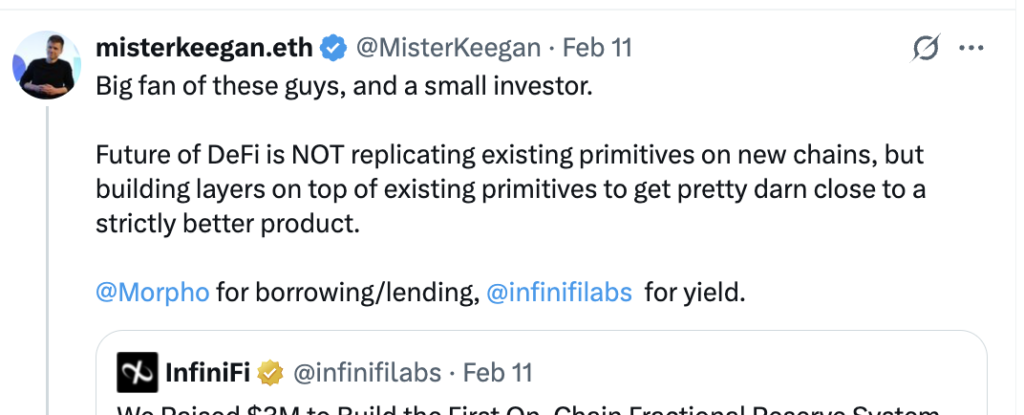

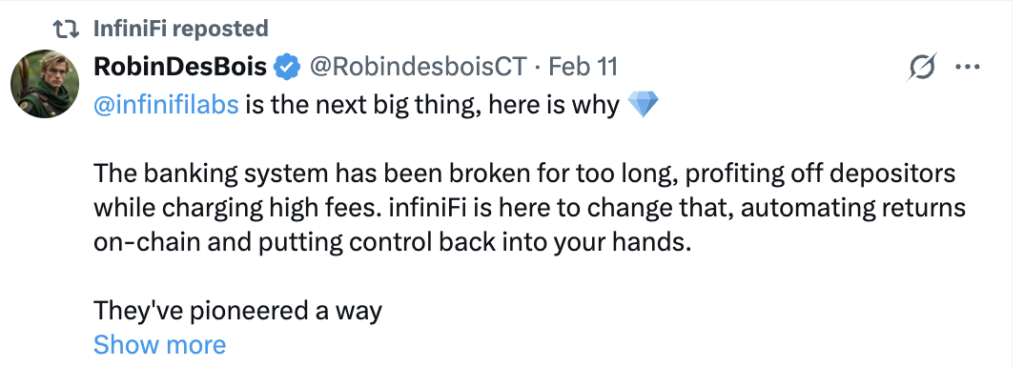

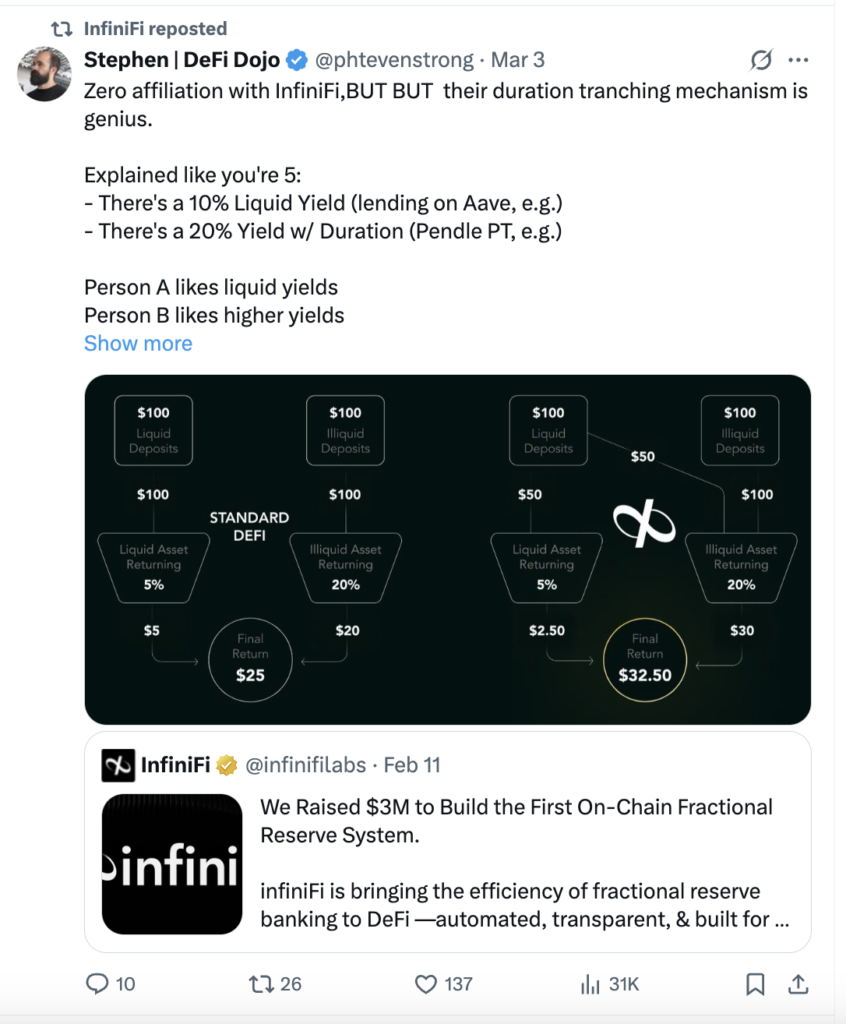

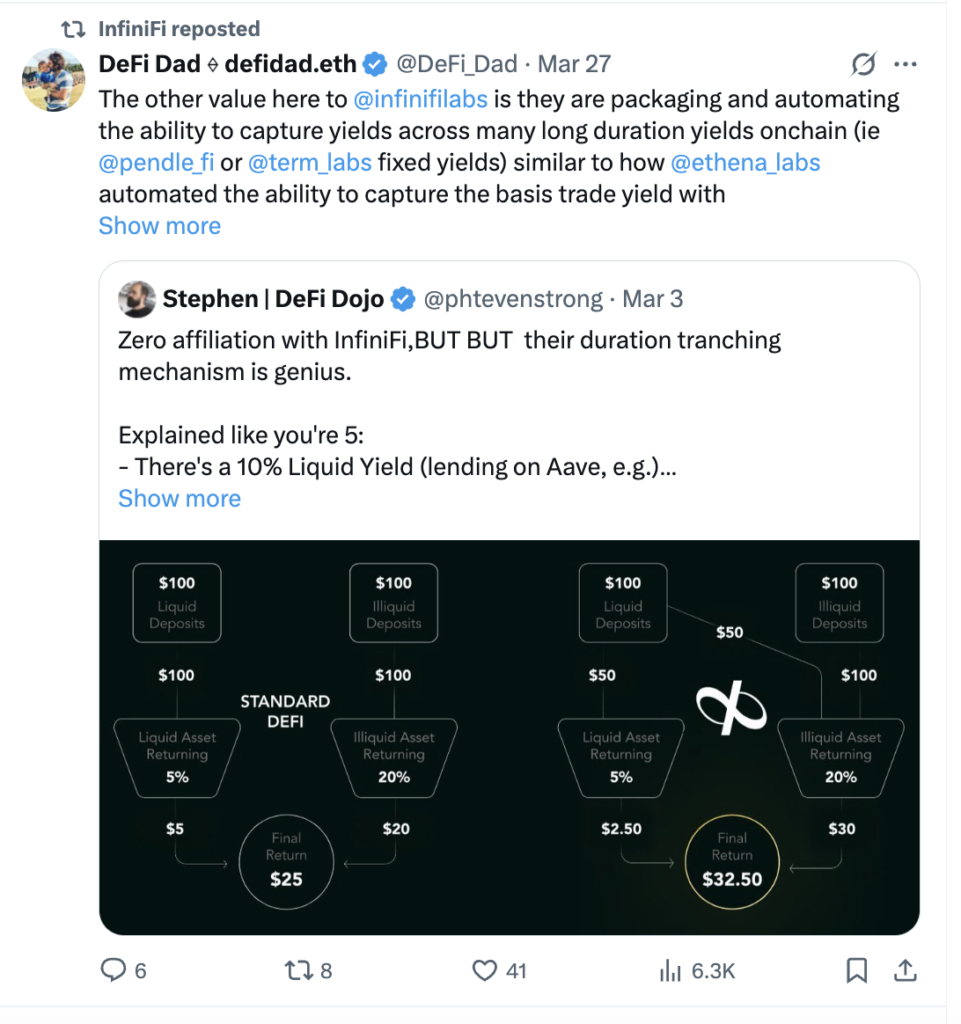

And here come the KOLs — the first mentions from accounts with hundreds of thousands of followers:

An interesting move.

David Hoffman from Bankless.com posts that the market is in bad shape and he’s feeling depressed. Rob Montgomery, the CEO of InfiniFi, replies saying they’re building an awesome product — and then the official company account reposts his response.

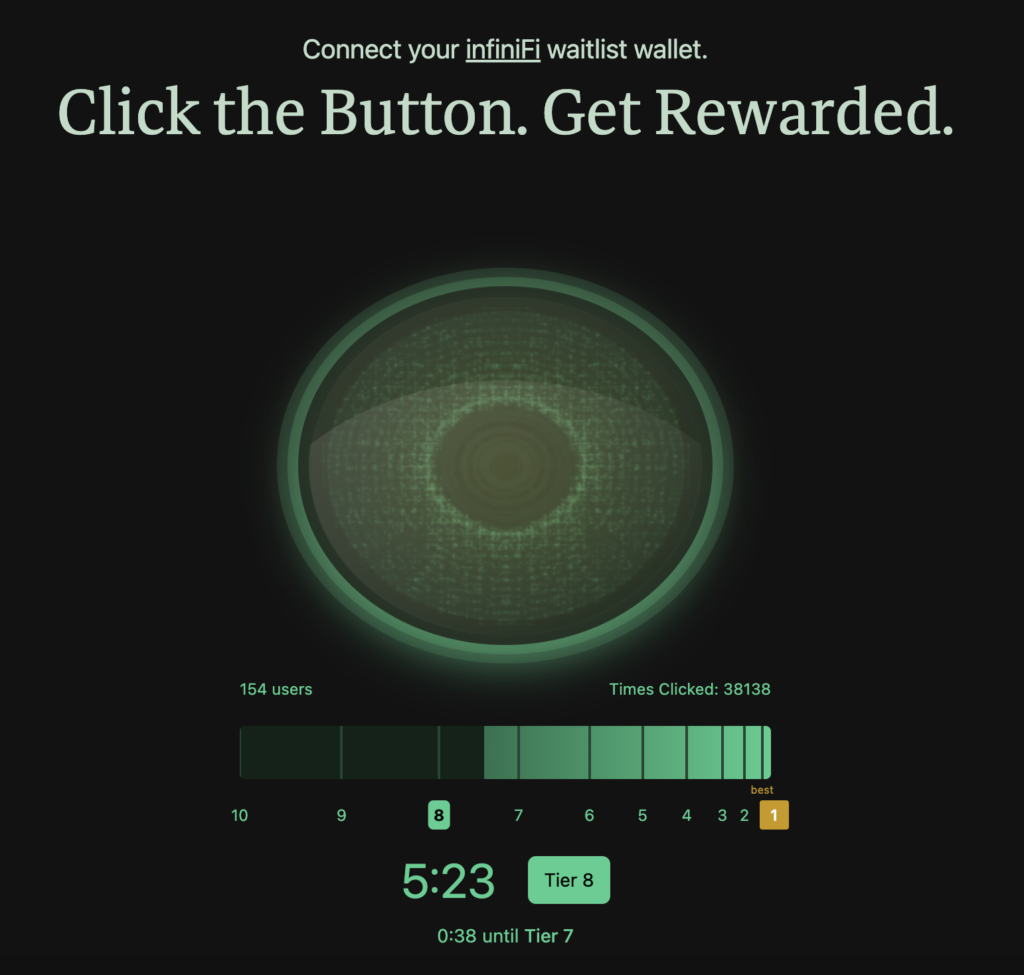

The activity kicks off — a tap-to-earn mechanic with gamification elements:

Inside:

Next, you need to connect your wallet and keep engaging with the activity to receive NFTs and other rewards — and secure a spot on the waitlist.

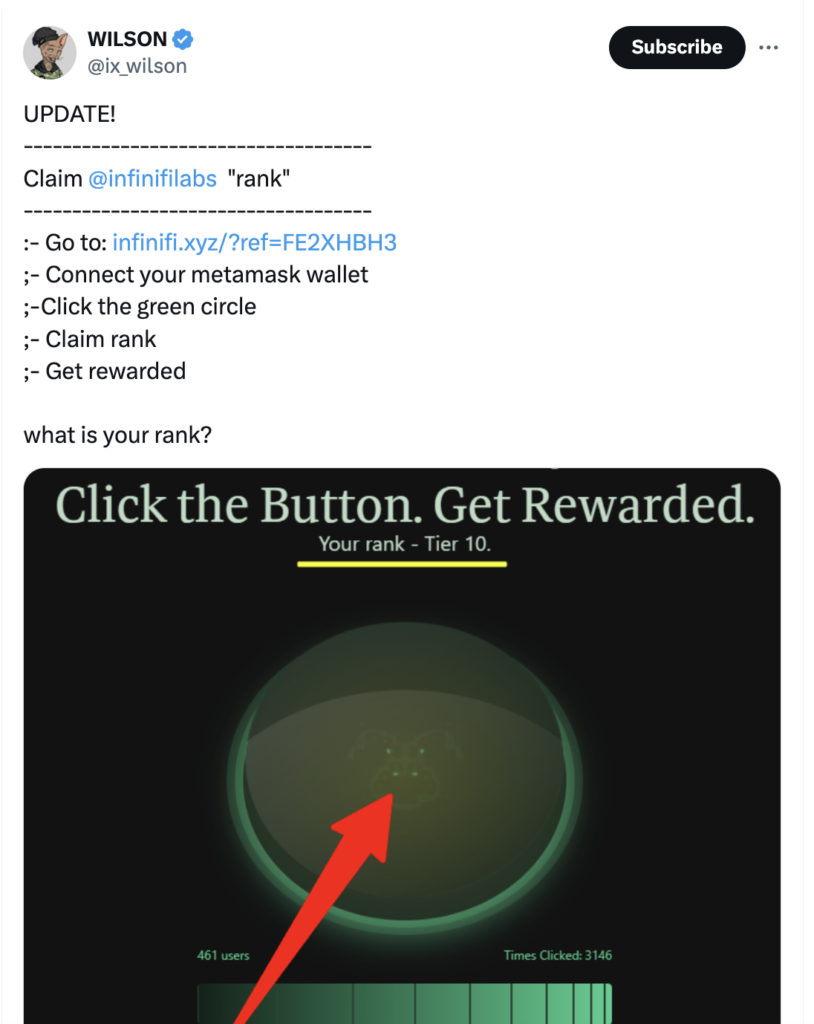

This activity is picked up and reposted by KOLs (one shown in the screenshot has 300k followers):

Haha, look at how the official account is building hype in the influencer’s comment section:

Here’s another clever move: there are two paid influencers involved. First, one of them does an integration, and then the second one follows up by reposting the first influencer’s tweet as their own integration.

Strategy for Launching a New DeFi Project to Market

- Securing investments — the starting point for active media presence

- Initial seeding and active participation of the project’s CEO in events

- Launch of contest-based activities

- Support from influencers to boost engagement

We recommend diversifying your channels and promoting the website in parallel, with greater focus on reach and exposure.

Come to crypto teki to get the most targeted reach for your DeFi, Web3, and crypto projects.